Experian’s Sustainability Strategy

We’re using our data, products, expertise and innovation to help people thrive on their financial journey - and address some of the world's most pressing financial health challenges.

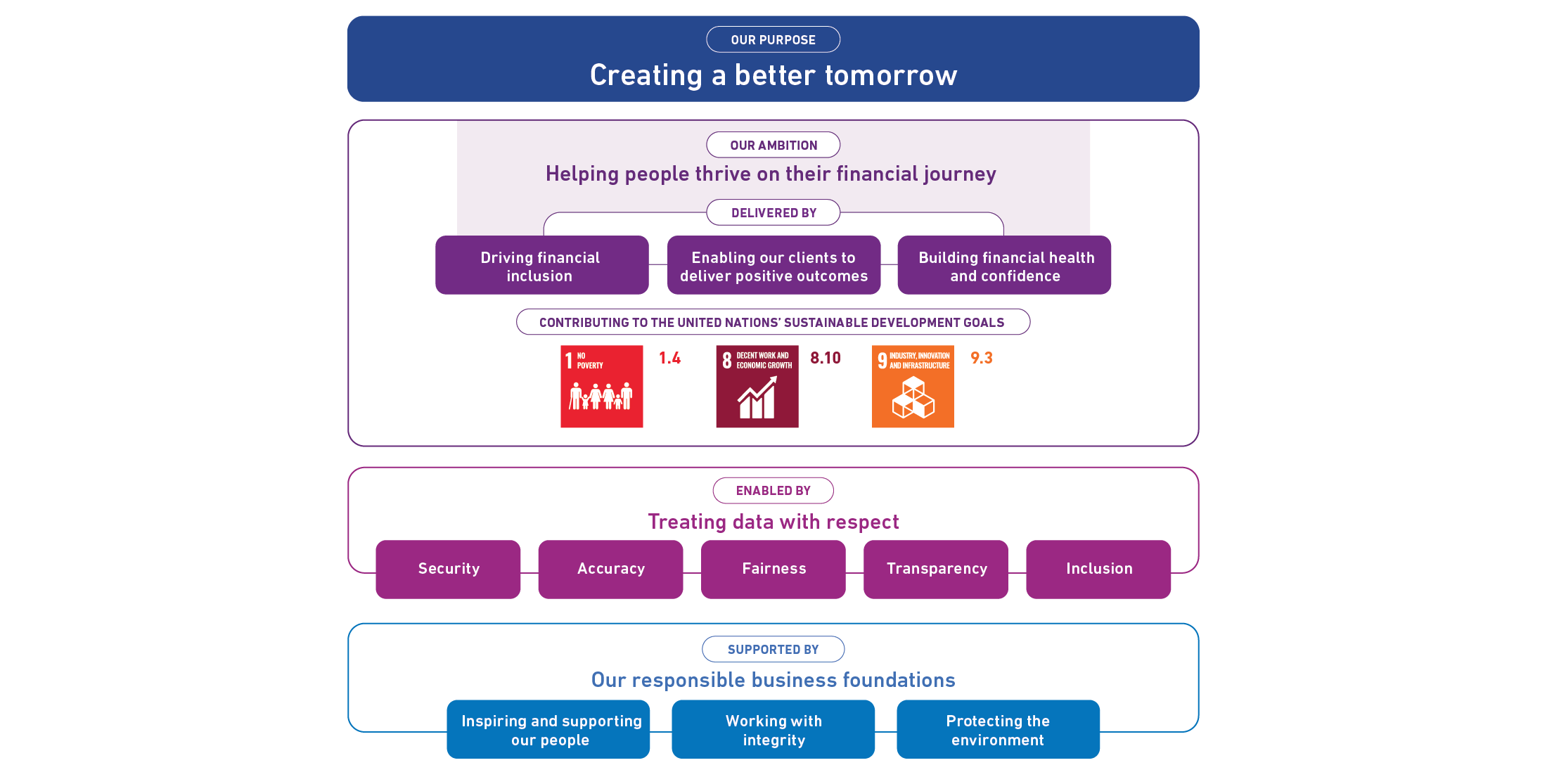

Our sustainability strategy shows how we’ll deliver our ambition – and how this is enabled by treating data with respect, supported by our responsible business foundations and underpinned by robust governance.

Aligning our Sustainability and Growth Strategies

Our sustainability and growth strategies reinforce each other.

Three of our five focus areas support our ambition to help people thrive on their financial journey:

- make credit and lending simpler, faster and safer for consumers and businesses

- empower consumers to improve their financial lives

- help businesses verify identity and combat fraud

At the same time, Experian’s commitment to sustainable business helps us deliver our growth strategy and build strong relationships with stakeholders.

Our ambition to help people thrive on their financial journey supports our business by:

- Growing potential to access millions of new consumers, for us and our clients, by enhancing financial inclusion

- Broadening our relationships with consumers and small businesses through financial education programmes that enable them to use our consumer-facing products

- Generating new revenue streams with products that support financial inclusion

- Enhancing our offerings to clients with new products and services that enable them to deliver positive outcomes for their customers

- Using consumer-consented data to enrich our datasets and create new solutions that can add value for our business and help consumers thrive

- Attracting and retaining talent, and motivating our people, as employees increasingly want to work for companies with purpose

Awards

Our sustainability journey has been recognised by external organisations