Our history

Experian has a long history of innovation, with roots dating back to 1826

Experian’s roots stretch back to the days when it pioneered the concept of collecting credit data into databases which came to be known as credit bureaux. As technology evolved, we recognised the huge potential of data to power businesses and transform access to services for people and businesses. As our business has evolved we have successfully diversified into new markets and unlocked exciting opportunities.

Experian was a credit reporting company

Experian started to provide analytical insights to clients in addition to credit scores

Experian’ business strategy extends into new services to improve consumer financial health

Experian expands its consumer financial health platform, powers opportunities through new integrated platforms across industries, across the world

Experian dates back to 1826, when a group of London merchants began exchanging information on customers who failed to settle their debts. Since then, we’ve gone through many changes to become the innovative, technology-driven organisation we are today.

A group of London merchants start swapping information on customers who fail to settle their debts. One such association, the Manchester Guardian Society, formed in 1826, later became an integral part of Experian.

Jim Chilton joins his uncle’s law firm in Dallas, Texas. He begins to list both good and bad credit risks and persuades merchants to pool credit information. Later the Chilton business became part of Experian.

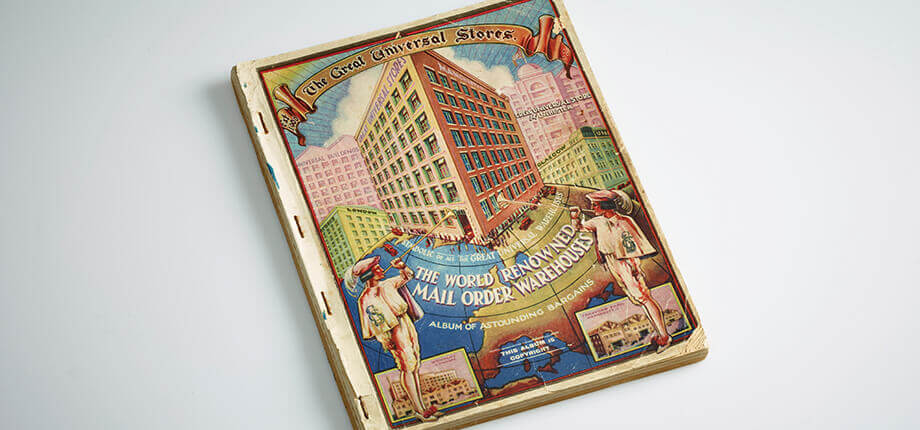

Abraham Rose founds Universal Stores in Manchester, in the UK. Later known as Great Universal Stores (GUS), it becomes one of the UK’s largest home mail order companies and its vast stores of data gave birth to Experian’s UK operations.

Simon Ramo and Dean Wooldridge, two of the world’s most famous aerospace engineers, appear on the cover of TIME magazine. In 1961, Simon Ramo predicts the ‘cashless society’. They later form TRW, a partnership with Thompson Products.

A consortium of Brazilian banks forms Serasa. Like its American and British counterparts, Serasa undergoes waves of technical advancement, installing its first computer in 1981 and linking its database to the banks by 1989.

A strategy is started to use analytical skills to develop new targeted marketing products. New products are launched just as the boom in direct marketing gets under way.

TRW dips its toe into the US direct-to-consumer market, with a service called Credentials. However, the concept is ahead of its time and it would require the development of the internet to establish the consumer as a customer.

Experian is formed when the UK business and US business (previously known as TRW) are combined under the ownership of GUS and rebranded as Experian

On 10 October 2006, Experian demerges from GUS to become an independent company listed on the London Stock Exchange, with an initial share price of £5.60. Under Don Robert’s leadership, Experian aims to develop its business worldwide.

Experian takes a controlling interest in Serasa, the world’s fourth largest credit bureau and the biggest in Brazil. This is the most significant step since the British and American businesses were combined in 1996. Experian later increased its stake to own substantially the whole of the Serasa in 2012.

Heart of Experian launches, to inspire the commitment and involvement of every employee. Don Robert states that, “At Experian, either everyone is a rock star or no one is a rock star. We get things done in partnership.”

A new era dawns for Experian with the retirement of Sir John Peace, the chair and one of Experian’s founders. A new team, Brian Cassin, CEO, and Lloyd Pitchford, CFO, continue the pioneering spirit and move into promising new high growth markets.

We refreshed our brand. Our brand reflects who we are, what we do and what we believe in. It describes what we do and our purpose — powering opportunities and helping to create a better tomorrow — for people, businesses and society.

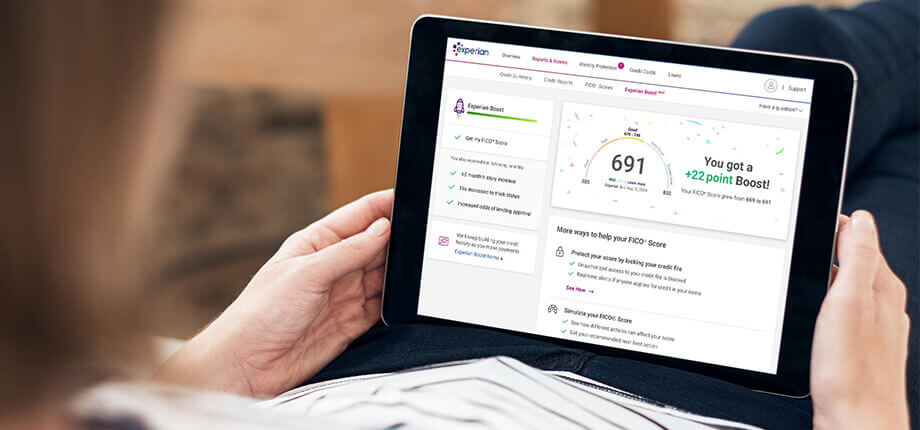

2019 marked a notable milestone in our company’s history and for consumers. We officially launched Experian Boost, a free tool that, for the first time, allows millions of consumers to add positive payment history directly into their credit file for an opportunity to instantly increase their credit score. It’s also the first of our products that allow consumers to use their own data to empower themselves in their financial lives.

We expand into Verification and Employer Services, and launch new real-time income and employment verification products. These services are secure, scalable, and transparent. We’re making a difference by offering our clients competitive verification options and helping consumers get better access to credit.

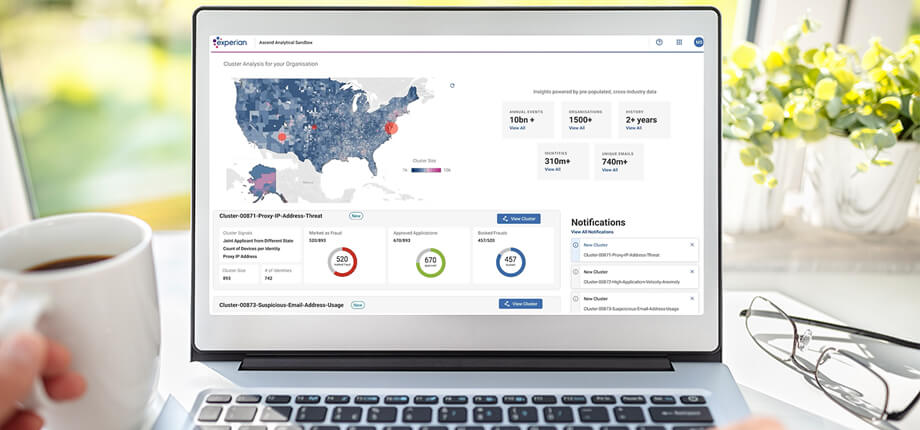

Innovation continues apace at Experian with the unveiling of Ascend Platform, an industry-first solution that brings together data, analytics, software, fraud prevention, and more, all within one integrated platform.

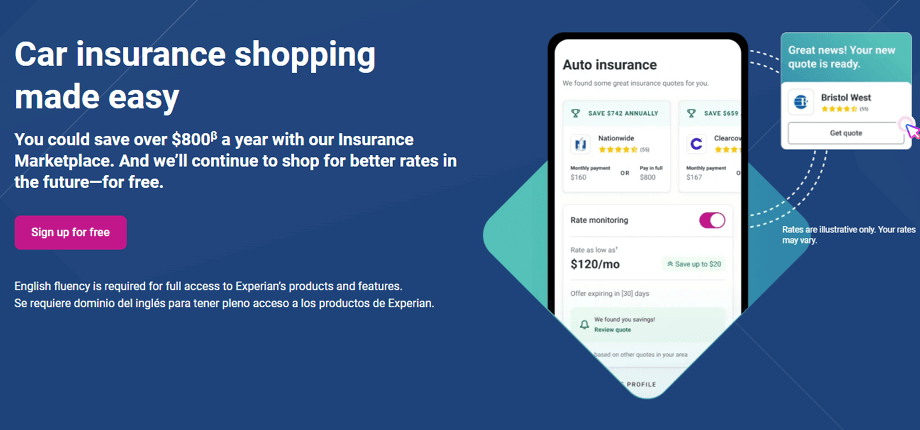

We took our consumer marketplace ecosystem further by introducing two new industry-first offerings: Experian Smart Money, a digital checking account designed to help build credit, and Experian Insurance Marketplace, our free auto insurance solution. These deeper connections with consumers, in turn, unlock a substantial new market for us.

Find out how we work towards our purpose — to create a better tomorrow for consumers, for businesses, for our people and for our communities.

By understanding the needs of our stakeholders, we’re able to effectively engage with them.

We transform data into information to help people to improve their financial lives. Our strategy is based on five high-impact focus areas.

We use our capabilities and data as a force for good for our consumers, clients and communities.