| Capital allocation policy and outstanding debt |

| Capital allocation policy |

| Our free cash flow has consistently been strong which has been a key pillar of our disciplined capital allocation: |

| - Our first priority is to invest in organic innovation to drive growth in the company; |

| - Secondly we aim to grow the dividend in line with underlying earnings growth; |

| - Thirdly we look at selective acquisitions which fit with our strategic priorities; and |

| - We also consider share repurchases. These are normally only done for offsetting the dilutive effect from employee and executive share reward schemes. |

| Financing strategy |

| - Our leverage policy is to target benchmark Net debt in the range of 2.0–2.5x EBITDA, commensurate with maintaining a strong investment grade rating (BBB+ / Baa1 or above). Net debt on 31 March 2025 was US$4,684m (2024: US$4,053m), 1.8 times Benchmark EBITDA (2024: 1.7 times). |

| - When refinancing we aim to space out our debt maturities to mitigate refinancing risk in any one year. |

| - We hold substantial undrawn committed bank facilities in order to maintain liquidity. |

| Bank facilities |

| As at 31 March 2025 we had: |

| - Undrawn committed revolving credit facilities from banks totalling US$2.4bn, with four years average remaining tenor. This includes our core US$1.8bn club facility, committed until March 2029. |

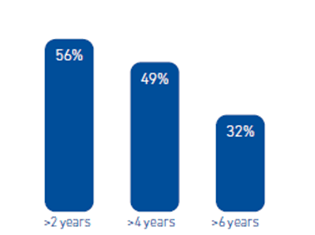

| - US$4.6bn of outstanding bonds, with an average remaining tenor of five years. The next bond maturity is in October 2025 and 66% of bonds have maturities exceeding four years. |

| - Cash and Cash equivalents of US$368m. |

| All our bank facilities contain one financial covenant requiring us to keep an interest cover of Benchmark EBIT being at least 3x net interest (excluding IFRS16 impact). As at 31 March 2025 this cover was 14x. |

| Interest rate risk |

| - Our policy is to hold 50% - 100% of our net funding at fixed interest rates, with the remainder being held at floating interest rates. |

| - As at 31 March 2025, 76% of our net funding was at fixed interest rates, mitigating the impacts of general rate rises. |

| - Our debt levels are usually lower at the end of the financial year due to strong cash inflows during the second half of the financial year. This typically increases the proportion of our debt that is fixed rate at 31 March. Conversely, debt levels are usually higher at 30 September as we pay staff incentives in June and the final dividend in July, which then reduces the proportion of debt which is at fixed rates. |

| - We use interest rate swaps to adjust the balance between fixed and floating rate debt. The effective interest rate on loan and bond debt, including derivatives, was 3.3% for the year ended 31 March 2025 (2024: 3.1%). |

| FX risk |

| - In business trading our revenues and costs are substantially in the same currency for most countries, minimising transactional FX risk. There is a translation risk when local currencies are converted into USD. |

| - Our borrowings are in USD, GBP, EUR and AUD. Looking at our total borrowings (bonds, drawn bank facilities and commercial paper) we aim for an allocation of our borrowings broadly in line with the currencies of our earnings, though we do not borrow in Brazilian Real or Colombian Peso. We use FX contracts to manage residual currency risk exposures. |

Credit ratings

Our aim is to maintain a strong investment grade credit rating (BBB+ / Baa1 or above). Our current credit ratings are:

| Standard & Poor’s | Moody’s | |

| Long term | A- | A3 |

| Long term outlook | Stable | Stable |

| Short term | A-1 | P-2 |

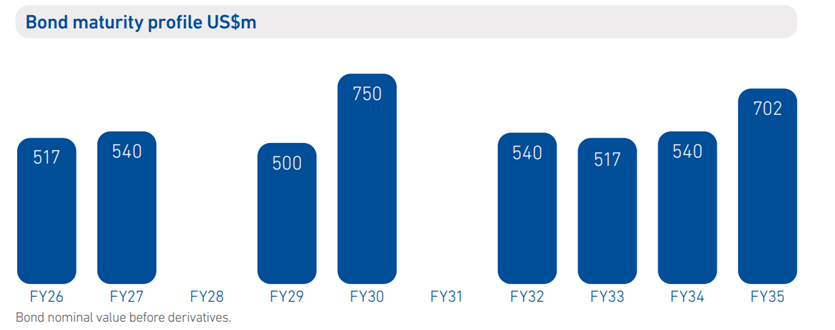

Bond maturity profile

Experian aims to maintain a smooth maturity profile for its bond debt to minimise refinancing risk in any given year.

Position at 31 March 2025; financial years shown.

The values shown above are shown before the impact of cross-currency swaps and FX forward contracts. The FX rates used to translate GBP and EUR bonds to USD are the rates as at 31 March 2025.

Outstanding debt

| Bond debt | Issuer | Currency | Amount (mils) | Coupon | Maturity date | Issue date | Series | Rating |

| Euronotes | Experian Finance plc | GBP | 400 | 0.739% | 29 Oct 2025 | October 2020 | EMTN | A- stable outlook / A3 stable outlook |

| Euronotes | Experian Finance plc | EUR | 500 | 1.375% | 25 Jun 2026 | May 2017 | EMTN | A- stable outlook / A3 stable outlook |

| US Notes | Experian Finance plc | USD | 500 | 4.25% | 1 Feb 2029 | January 2019 | A- stable outlook / A3 stable outlook | |

| US Notes | Experian Finance plc | USD | 750 | 2.75% | 8 March 2030 | December 2019 | A- stable outlook / A3 stable outlook | |

| Euronotes | Experian Europe DAC | EUR | 500 | 1.56% | 16 May 2031 | February 2022 | EMTN | A- stable outlook / A3 stable outlook |

| Euronotes | Experian Finance plc | GBP | 400 | 3.25% | 7 Apr 2032 | April 2020 | EMTN | A- stable outlook / A3 stable outlook |

| Euronotes | Experian Finance plc | EUR | 500 | 3.51% | 15 Dec 2033 | January 2025 | EMTN | A-stable outlook / A3 stable outlook |

| Euronotes | Experian Finance plc | EUR | 650 | 3.375% | 10 Sep 2034 | Sep 2024 | EMTN | A- stable outlook / A3 stable outlook |

EMTNs and 144As / Bonds & Notes

06 June 2025

Supplement to Base Listing Particulars 5 March 2024

27 May 2025

7 March 2025: Euro Medium Term Note Base Listing Particulars (2025)

27 May 2025

23 January 2025: Final terms - €500m 3.51% notes due 2033

16 January 2025

Supplement to Base Listing Particulars 5 March 2024

26 September 2024

Final terms - €650m 3.375% notes due 2034

26 September 2024

Supplement to Base Listing Particulars 5 March 2024

05 March 2024

Euro Medium Term Note Base Listing Particulars (2024)

14 March 2023

Euro Medium Term Note Base Listing Particulars (2023)

15 February 2022

Final terms - €500m 1.56% notes due 2031

08 February 2022

Supplement to Base Listing Particulars 24 January 2022

24 January 2022

Euro Medium Term Note Base Listing Particulars (2022)

28 September 2020

Final terms - £400m 0.739% notes due 2025

16 September 2020

Supplement to Base Listing Particulars 12 March 2020

31 March 2020

Final terms - £400m 3.25% notes due 2032

12 March 2020

Euro Medium Term Note Base Listing Particulars (2020)

10 December 2019

Final terms - $750m 2.75% US notes due 2030

03 December 2019

US Notes Listing Particulars (2019)

31 January 2019

Final terms - $500m 5.25% US notes due 2029

28 January 2019

US Note Listing Particulars (2019)

27 June 2018

Final terms - £400m 2.125% notes due 2024

18 June 2018

Supplement to Base Listing Particulars Dated 23 May 2018

23 May 2018

Euro Medium Term Note Base Listing Particulars (2018)

19 May 2017

Final Terms - €500 million 1.375% notes due 2026

18 May 2017

Supplement to Base Listing Particulars Dated 9 March 2017

09 March 2017